Unify all your operations on one platform

We deliver end-to-end digital payment solutions that help businesses simplify operations, enhance customer experiences, and accelerate digital transformation. Our solutions are built to meet the evolving needs of banks, financial institutions, and enterprises—combining innovative technology, seamless integration, and unmatched reliability.

Innovative Payment Solutions for

a Smarter Digital Future

Digital onboarding and identity verification (eKYC)

A fully digitized onboarding experience that enables financial institutions to verify customer identities quickly, securely, and with minimal friction. Our eKYC platform automates document verification, biometrics, and background checks, eliminating the need for physical paperwork and manual processes. With real-time validation, enhanced compliance, and seamless integration into existing systems, it helps organizations onboard customers faster while maintaining the highest regulatory and security standards.

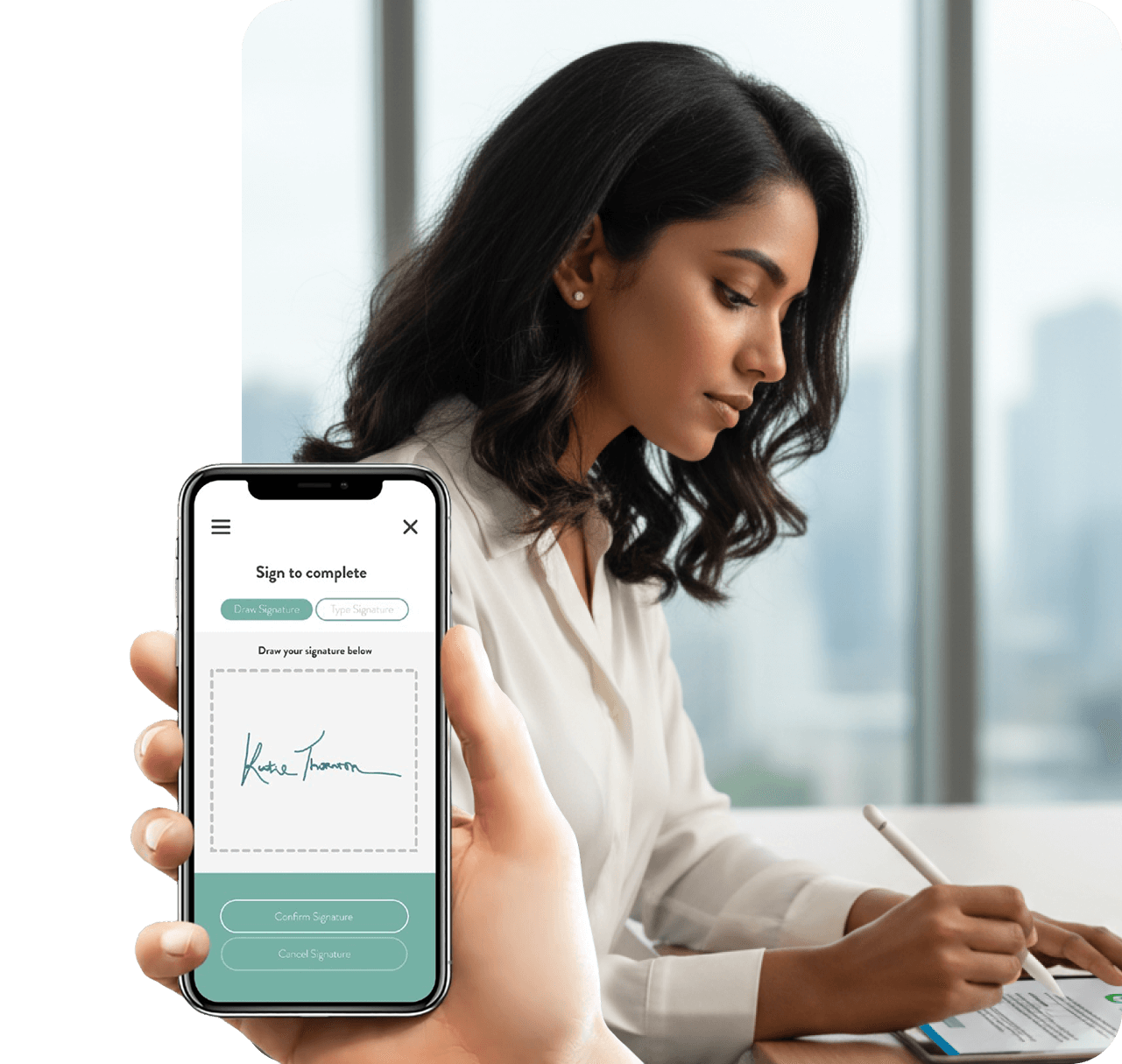

Digital Signature

A secure and compliant digital signing solution that allows customers to sign documents anywhere, anytime, from any device. Our platform ensures authenticity, integrity, and non-repudiation through advanced encryption and audit trails. By replacing manual signature workflows with a fully electronic process, businesses can accelerate approvals, reduce operational costs, and streamline customer experiences while maintaining industry-grade security and trust.

Wallet Services

A versatile and user-friendly digital wallet designed for seamless payments, transfers, and daily financial activities. Customers can store funds, make purchases, send money, and manage transactions instantly from a single interface. Built with enterprise-grade security, multi-layer authentication, and real-time notifications, our wallet service delivers convenience, safety, and accessibility empowering users to handle their finances effortlessly anytime, anywhere.

Agency Banking

A comprehensive suite of intelligent banking tools designed to elevate digital customer experiences. Featuring mobile and internet banking, automated workflows, analytics, and AI-powered financial insights, our Smart Banking ecosystem helps institutions deliver personalized, secure, and responsive services. It streamlines operations, improves engagement, and supports the future of digital banking by integrating innovation with robust reliability.

Smart and EFT POS (Electronic Funds Transfer Point of Sale)

An advanced POS ecosystem combining smart device capabilities with secure EFT payment processing. Merchants can accept card, wallet, and digital payments with speed and reliability, supported by intuitive interfaces and real-time transaction updates. Designed for high performance, the system improves checkout experiences, minimizes downtime, and enhances customer satisfaction.

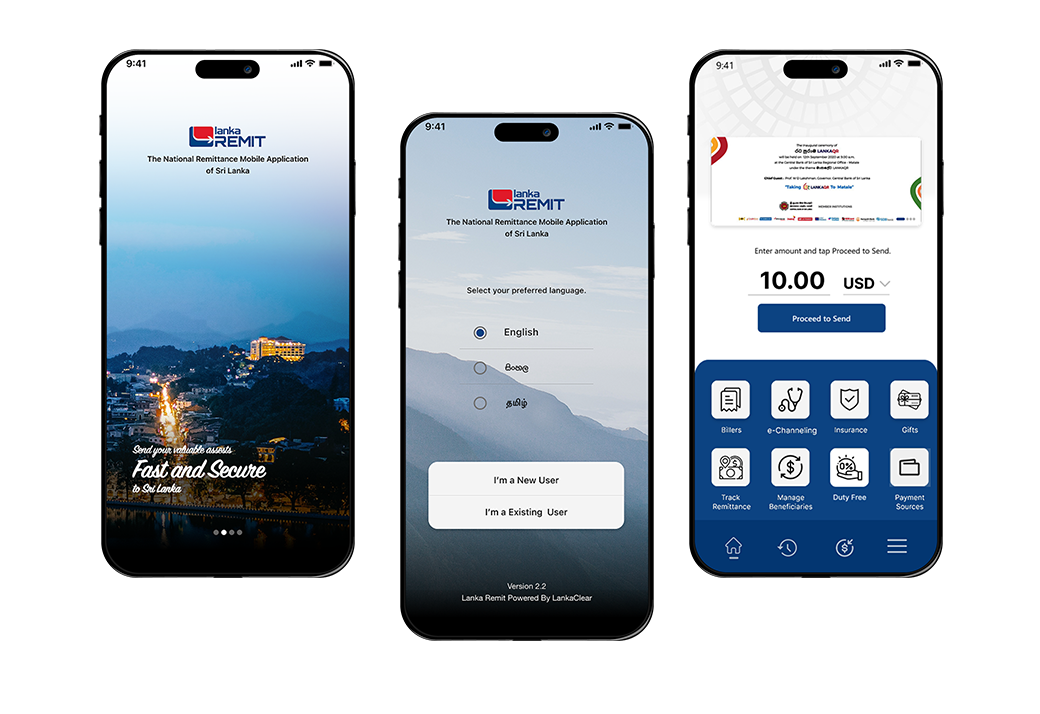

Remittance System

A robust cross-border remittance platform enabling fast, secure, and compliant international money transfers. It supports multiple currencies, real-time settlement, and seamless integration with banks and financial institutions. Built with high-level compliance, fraud prevention, and automated monitoring, the system ensures both senders and recipients enjoy a safe and reliable remittance experience while reducing processing times and operational complexities.

Digital Payment Platforms/ Mobile App

A fast and secure digital payment solution enabling instant, seamless transactions between customers and merchants. By bypassing traditional intermediaries, DirectPay reduces processing times and costs while ensuring maximum transparency. With QR-based payments, online integrations, and robust security controls, it provides a smooth checkout experience across physical and digital environments, empowering businesses to accept payments effortlessly and efficiently.